/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

The SECURE 2.0 Act, signed into law in December 2022, has introduced significant changes to the retirement savings landscape. One of the key provisions of this act is the introduction of catch-up-as-Roth contributions, which allows individuals aged 50 and above to make catch-up contributions to their retirement accounts on a Roth basis. Recently, the IRS has proposed regulations to implement this provision, and in this article, we will delve into the details of these regulations and their implications for retirement savers.

What are Catch-Up-As-Roth Contributions?

Catch-up contributions are additional contributions that individuals aged 50 and above can make to their retirement accounts, such as 401(k), 403(b), and IRA plans. Prior to the SECURE 2.0 Act, these contributions were made on a pre-tax basis, reducing the individual's taxable income for the year. However, with the introduction of catch-up-as-Roth contributions, individuals can now choose to make these contributions on a Roth basis, which means they will pay taxes on the contributions upfront, but the funds will grow tax-free and be distributed tax-free in retirement.

IRS Proposed Regulations: Key Highlights

The IRS has proposed regulations to implement the catch-up-as-Roth contribution provision, which include the following key highlights:

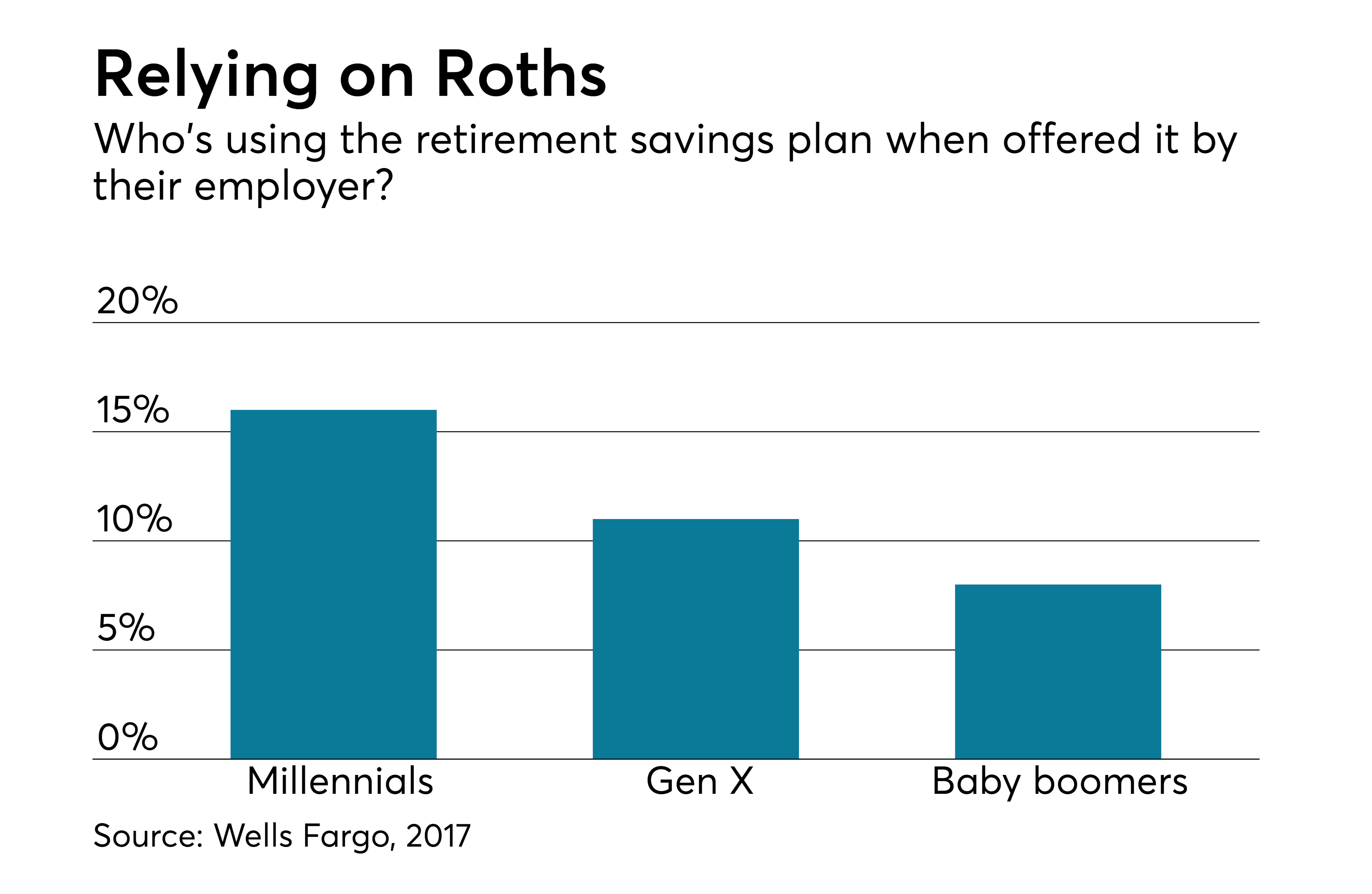

Eligibility: The regulations clarify that only employees aged 50 and above are eligible to make catch-up-as-Roth contributions.

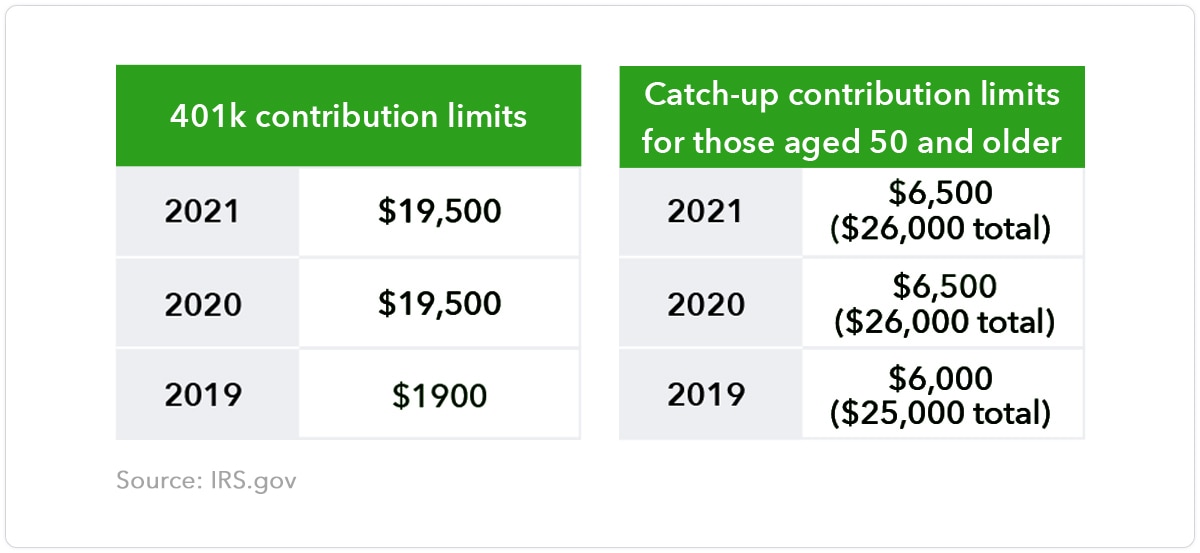

Contribution Limits: The regulations confirm that the catch-up-as-Roth contribution limit is $7,500 in 2023, which is the same as the catch-up contribution limit for pre-tax contributions.

Plan Sponsor Requirements: The regulations require plan sponsors to provide employees with the option to make catch-up-as-Roth contributions, and to amend their plans to reflect this change.

Participant Elections: The regulations provide guidance on how participants can elect to make catch-up-as-Roth contributions, including the requirement that participants must affirmatively elect to make these contributions.

Implications for Retirement Savers

The introduction of catch-up-as-Roth contributions provides retirement savers with greater flexibility and control over their retirement savings. By making catch-up contributions on a Roth basis, individuals can create a tax-free source of income in retirement, which can be particularly beneficial for those who expect to be in a higher tax bracket in retirement.

Additionally, catch-up-as-Roth contributions can help individuals reduce their tax liability in retirement, as they will not be required to take required minimum distributions (RMDs) from their Roth accounts. This can be especially beneficial for those who want to leave a tax-free inheritance to their beneficiaries.

The SECURE 2.0 Act's introduction of catch-up-as-Roth contributions is a significant development in the retirement savings landscape. The IRS's proposed regulations provide much-needed guidance on the implementation of this provision, and retirement savers should carefully consider the implications of making catch-up contributions on a Roth basis. By understanding the rules and regulations surrounding catch-up-as-Roth contributions, individuals can make informed decisions about their retirement savings and create a more secure financial future.

In conclusion, the SECURE 2.0 Act's catch-up-as-Roth contribution provision is a powerful tool for retirement savers, and the IRS's proposed regulations provide a clear framework for implementation. As the retirement savings landscape continues to evolve, it is essential for individuals to stay informed and adapt their strategies to maximize their retirement savings. By doing so, they can unlock the full potential of their retirement accounts and create a brighter financial future.

Note: The information provided in this article is for general information purposes only and should not be considered as tax or investment advice. It is essential to consult with a financial advisor or tax professional to determine the best course of action for your individual circumstances.

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)