Table of Contents

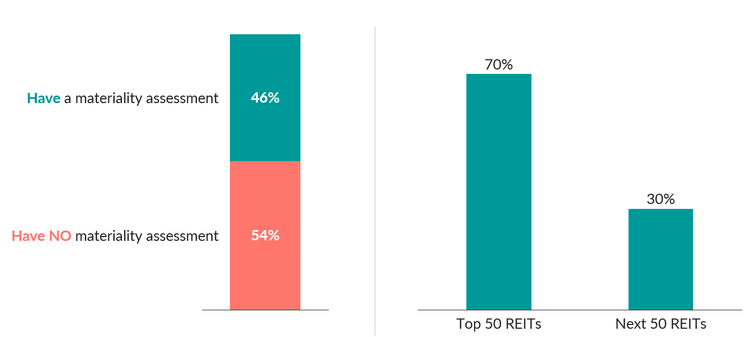

- Are REITs Doing Enough About Sustainability? - Telesto

- Ariana Grande plans 2025 stadium gigs

- Top 10 ASX REITs to watch in 2023 - Syfe Australia

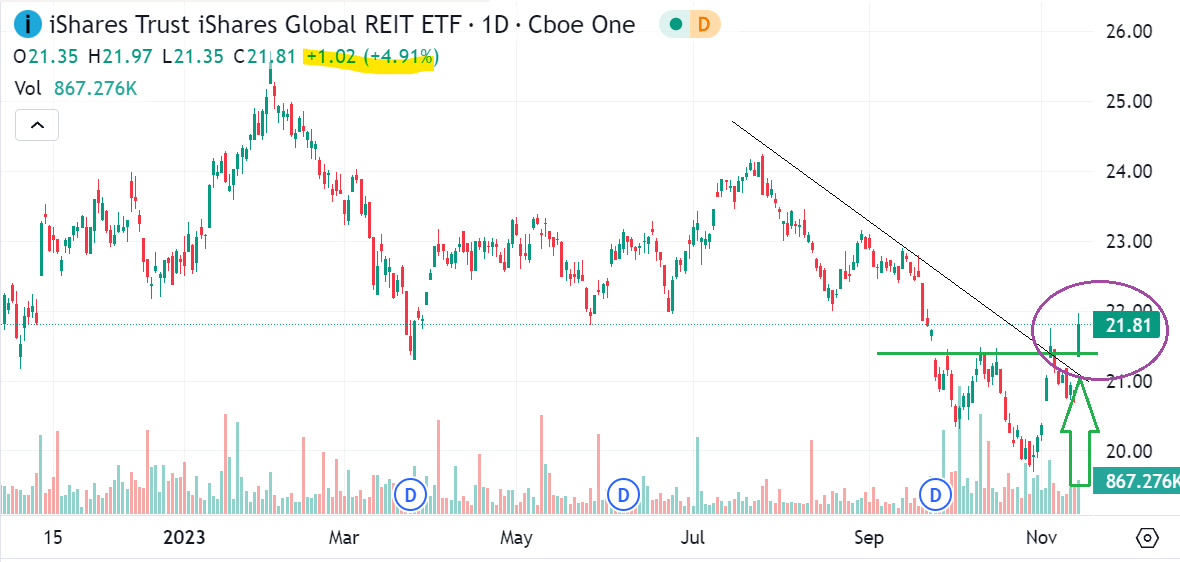

- REET ETF: Bullish Tailwinds For Global REITs Into 2024 | Seeking Alpha

- 4 REITs that could outperform in 2023 - SmallCapAsia

- 10 Of The Best REITs To Buy For 2024 | Seeking Alpha

- REET ETF: Bullish Tailwinds For Global REITs Into 2024 | Seeking Alpha

- Top 3 Singapore REITS To Watch Out For In 2024

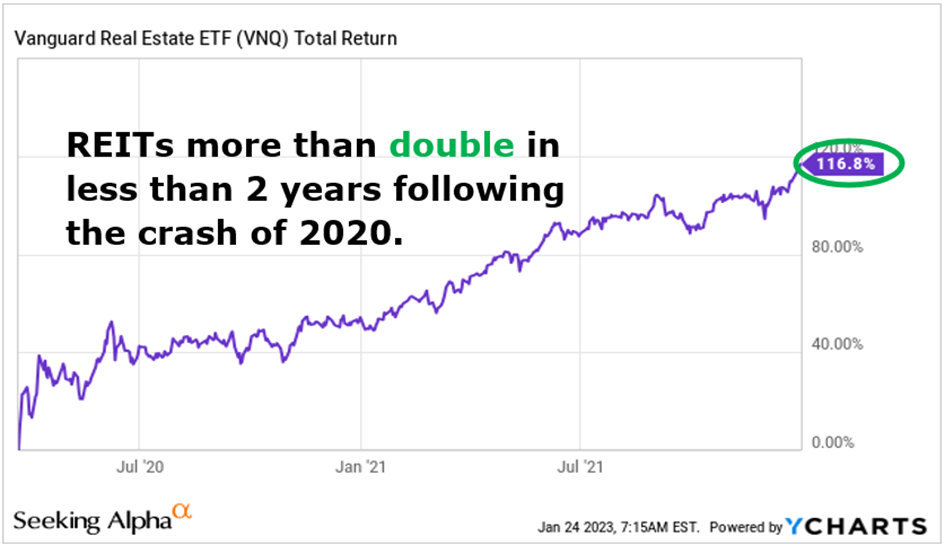

- 2 REITs That Could Soar In 2024

- 5 REITs Poised for Growth in 2025 – Top Real Estate Investments to ...

Introduction to REITs

Fundrise: A Pioneer in Real Estate Investing

CrowdStreet: Commercial Real Estate Investing

CrowdStreet focuses on commercial real estate investing, offering accredited investors the opportunity to invest in individual properties or through its diversified portfolios. With a minimum investment of $10,000, CrowdStreet caters to investors looking for more control over their investments. Its platform provides detailed information about each property, including financial projections and property management details, allowing for well-informed investment decisions.

Yieldstreet: Alternative Investments

Yieldstreet expands the horizon of real estate investing by offering alternative investment options, including real estate, art, and legal financing. This platform is designed for accredited investors seeking higher returns, typically in the range of 8-12% per year, though these come with higher risks. Yieldstreet's real estate investments often involve debt or equity financing for property development or existing properties, providing a unique entry point into the real estate market.

Comparison and Conclusion

When comparing Fundrise, CrowdStreet, and Yieldstreet, several factors come into play, including investment minimums, fees, potential returns, and the level of risk. Fundrise is accessible to a broader range of investors due to its lower minimums and fees, making it a good starting point for those new to real estate investing. CrowdStreet offers more control and diversification within commercial real estate, appealing to investors with a higher risk tolerance and more substantial investment capital. Yieldstreet, with its alternative investments, caters to sophisticated investors seeking higher potential returns and willing to accept the associated risks. In conclusion, the best REIT for 2025 depends on your investment goals, risk tolerance, and the level of involvement you desire. Whether you're a seasoned investor or just starting out, platforms like Fundrise, CrowdStreet, and Yieldstreet offer innovative ways to engage with the real estate market. By understanding the unique offerings of each platform, you can make informed decisions that align with your financial objectives, ultimately helping you achieve success in your real estate investment journey.For more information and to start investing, visit the websites of Fundrise, CrowdStreet, and Yieldstreet to explore their current offerings and investment opportunities.